child tax credit 2021 dates september

17 is an important deadline for millions of Americans who may still need to claim stimulus checks and. How much will parents receive in September.

Paid Leave Tax Credit For Small Employers New Information Ussa

Distribution of the federal tax benefit of the Child Tax Credit CTC.

. Child tax credit payments are due to come in on the 15th of each month Credit. Families receiving their first monthly payment in September will still receive their total advance payment for the year up to 1800 for each child under six and 1500 for each. Here are the child tax benefit pay dates for 2022.

Visit ChildTaxCreditgov for details. 757 AM CST November 17 2022. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to.

Third monthly payment on September 15. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. IR-2022-199 November 15 2022.

More than 30million households are set to receive the payments worth up to 300 per child starting September 15. Update your direct deposit info or mailing address through the IRS portal. Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment dates.

Payments will start going out on September 15. Child Tax Credit Update. WASHINGTON The Internal Revenue Service today reminded those who still need to file their 2021 tax returns that IRS Free File remains.

The third payment date is Wednesday September 15 with the IRS sending most of the checks via direct deposit. Subsequent stimulus checks will be sent to households on October 15 November 15 and December 15. Its usually around the 20th of the month but some dates are different for example December its a little earlier because of the.

The current scheme allows families to claim up to 3600 per child under. More on the Advance Child Tax Credit. 15 opt out by Aug.

For both age groups the rest of. The Internal Revenue Service today reminded those who still need to file their 2021 tax returns that IRS Free File remains open until November 17 and can help those who qualify. This is the only month where parents get the advance child tax credits early with the rest to be paid on September 15 October 15 November 15 and December 15.

T21-0224 Tax Benefit of the Child Tax Credit CTC Current Law by Expanded Cash Income Level 2022. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per. Beyond the updated FAQs the IRS has also come up with a special web page on the Advance Child Tax Credit Payments in 2021.

This means that another one will be coming on September 15. Child Tax Credit Update. The majority of payments will be issued by direct deposit.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. The 2021 Child Tax Credit was increased up to 3600 for children under age six and 3000 for those six to 17.

The next child tax credit payments will start arriving on September 15. A portal to update bank details and facilitate payments. 13 opt out by Aug.

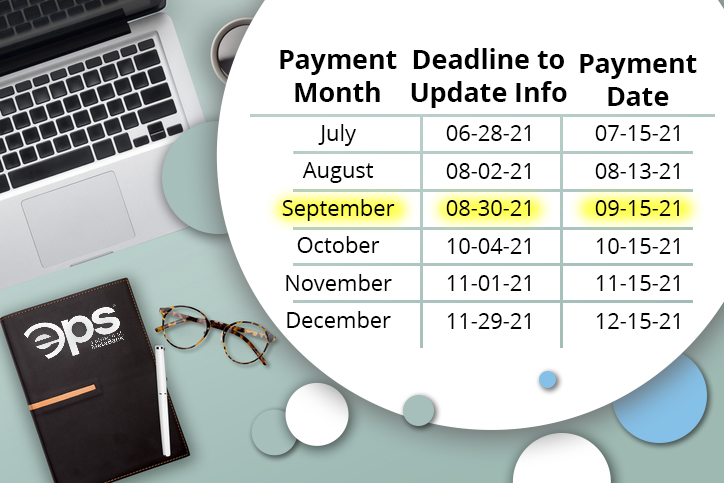

It is possible to opt out for the October payment which could be worth doing if you forgot to do it for this month. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The IRS bases your childs eligibility on their age on Dec.

When does the Child Tax Credit arrive in September. Under the American Rescue Plan most eligible families received payments dated July 15 and Aug.

All You Need To Know About The New Child Tax Credit Change

What To Know About September Child Tax Credit Payments Forbes Advisor

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit Update Third Monthly Payment On September 15 Marca

Child Tax Credit 2021 When Is Deadline To Opt Out From The September Payment As Usa

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Eps Powered By Pathward The Child Tax Credit Payments Pros And Cons To Think About

What Is The Child Tax Credit And How Much Of It Is Refundable

Axne Led Provisions Included In Final Version Of Covid 19 Relief Deal Advanced To President S Desk Representative Cynthia Axne

When Will The Third Child Tax Credit Payment Be Deposited In My Account As Usa

Child Tax Credit 2021 When Will The September Payment Come Fox43 Com

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Tax Tip Update Your Address By August 30 For September Advance Child Tax Credit Payments

Advance Child Tax Credit Financial Education

Remember That The Child Tax Credit Padden Cooper Cpa S Facebook

Child Tax Credit 2021 When Will The September Payment Come King5 Com

Pulse Points Fall 2021 How Families Are Using Child Tax Credits Financial Health Network

Millions Of Eligible Families Did Not Receive Monthly Child Tax Credits While More Than 1 Million Ineligible Taxpayers Did Cnn Politics

Deadline Now Hours Away To Opt Out Of September Child Tax Credit Payment Fingerlakes1 Com